HI BB-1X 2014-2024 free printable template

Show details

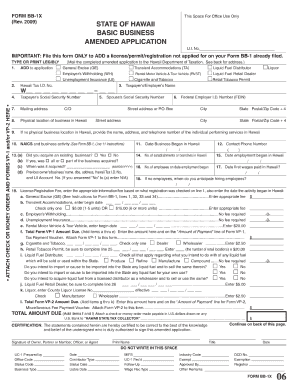

06 Clear Form BB-1X (Rev. 2014) This Space For Office Use Only STATE OF HAWAII BASIC BUSINESS AMENDED APPLICATION (NOTE: Reference to Spouse also means Civil Union Partner.) U.I. No. IMPORTANT: File

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form bb 1 hawaii form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form bb 1 hawaii form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form bb 1 hawaii online online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit hawaii bb 1x form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

HI BB-1X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form bb 1 hawaii

How to fill out hawaii bb 1x?

01

First, gather all the necessary information and documents needed to fill out the form.

02

Carefully read through the instructions provided with the form to understand the requirements.

03

Begin by providing your personal information accurately and completely, such as your name, address, and contact details.

04

Follow the instructions to provide the specific information required in each section of the form, such as employment details, income information, and any relevant supporting documentation.

05

Double-check your entries for any errors or omissions before submitting the completed form.

06

Sign and date the form as required.

Who needs hawaii bb 1x?

01

Individuals who are applying for a specific program or benefit in Hawaii that requires the completion of the hawaii bb 1x form.

02

Employers or organizations that need to provide certain information about their employees or participants for reporting or compliance purposes.

03

Any other parties as specified by the relevant authorities or agencies in Hawaii.

Fill bb 1x basic business online : Try Risk Free

People Also Ask about form bb 1 hawaii online

Do I have to pay general excise tax in Hawaii?

Who has to pay general excise tax in Hawaii?

Who pays excise tax in Hawaii?

What is Hawaii sales tax?

What is a BB 1 form Hawaii?

What form do I use for Hawaii estimated taxes?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file hawaii bb 1x?

All businesses operating in Hawaii with gross income of more than $4,000 must file Form BB-1X with the Department of Taxation.

When is the deadline to file hawaii bb 1x in 2023?

The deadline to file Hawaii BB-1X for tax year 2023 is April 20, 2024.

How to fill out hawaii bb 1x?

To fill out the Hawaii BB 1X form, follow these steps:

1. Obtain a copy of the Hawaii BB 1X form from the Hawaii Department of Taxation website or any authorized source.

2. Start by entering the relevant information in Section A: Taxpayer Identification and Filing Status. Provide your social security number or employer identification number (EIN), as well as your name, address, and filing status (single, married filing jointly/separately, or head of household).

3. In Section B: Exemptions, indicate the number of exemptions you are claiming. This refers to the number of individuals (including yourself and dependents) you are claiming as exemptions on your tax return.

4. Proceed to Section C: Tax Credits. Enter any applicable tax credits you are claiming. Report the amount of each credit and provide any necessary supporting documentation as directed by the form's instructions.

5. In Section D: Estimated Tax Payments and Tax Withheld, report the amount of estimated tax payments you have made throughout the tax year. Additionally, enter the total amount of tax withheld from your income, such as from employment or retirement benefits.

6. Move on to Section E: Addition/Subtraction Adjustments to Income. This section allows you to make any necessary adjustments to your total income by entering any additions or subtractions. Follow the instructions provided to accurately calculate these adjustments.

7. If you are eligible for any deductions, complete Section F: Itemized or Standard Deduction. Report the amount of itemized deductions or choose the appropriate standard deduction based on your filing status. Note that you may not claim both itemized and standard deductions.

8. Next, in Section G: Exemptions and Filing Group, report the number of exemptions you have claimed in Section B.

9. Finally, complete Section H: Credits. Enter any tax credits you are eligible for or have already claimed on your tax return.

10. Review the completed form for accuracy and ensure you have provided any necessary documentation or attachments as specified by the form's instructions.

11. Sign and date the form in the designated areas.

Note: It is crucial to carefully read the form's instructions and consult with a tax professional if you have any questions or concerns. The steps provided are a general guideline, but the specific requirements may vary depending on your individual circumstances and the current version of the form.

What is the purpose of hawaii bb 1x?

Hawaii BB 1X is not a known term or concept, so it is difficult to provide an accurate answer. It is possible that it refers to a specific product, service, or technology related to Hawaii or a specific company with the acronym "BB." Without more context or information, it is challenging to determine its purpose.

What information must be reported on hawaii bb 1x?

The Hawaii BB-1X is a form used to report information on the sales of the transient accommodations tax. The following information is typically required:

1. Name and contact information of the transient accommodations operator.

2. Reporting period – the time period for which the tax is being reported.

3. Which island(s) the accommodations are located on.

4. Total number of units available for transient accommodations during the reporting period.

5. Total number of units rented or occupied during the reporting period.

6. Total rental or occupancy of transient accommodations during the reporting period.

7. Gross rental or occupancy receipts received during the reporting period.

8. Any tax collected or received during the reporting period.

9. Any adjustments or deductions applied to the gross rental or occupancy receipts.

10. Net amount due or refundable to the transient accommodations operator.

Please note that this information may vary or be updated by the Hawaii Department of Taxation, so it is important to refer to the latest instructions and guidelines while filling out the form.

Can I create an eSignature for the form bb 1 hawaii online in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your hawaii bb 1x form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit hawaii revised statutes straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing certificate hawaii right away.

How do I complete hawaii bb 1x application on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your hawaii bb 1x application form from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Fill out your form bb 1 hawaii online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hawaii Revised Statutes is not the form you're looking for?Search for another form here.

Keywords relevant to hawaii form bb 1x application

Related to hawaii bb 1x basic application

If you believe that this page should be taken down, please follow our DMCA take down process

here

.